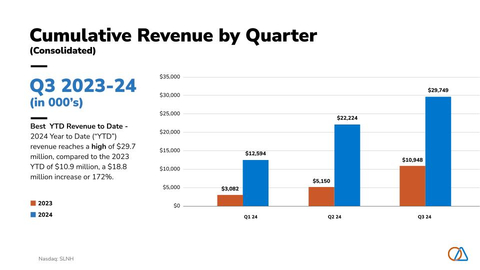

$18.8 Million Increase in Year-to-Date Revenue Year-Over-Year and Record Revenue Year-to-Date of $29.7 Million

Soluna Holdings Reports Q3’24 Results

John Tunison

Chief Financial Officer

Soluna Holdings, Inc.

jtunison@soluna.io

Soluna Holdings, Inc. (“SHI” or the “Company”), (NASDAQ: SLNH), a developer of green data centers for intensive computing applications including Bitcoin mining and AI, announced financial results for the third quarter ended September 30, 2024.

This press release features multimedia. View the full release here:

Severity: Warning Message: Undefined array key 3 Filename: views/newsdetail_view.php Line Number: 97 Backtrace:

File: /home/judfadzm/public_html/webinar4demand.com/application/views/newsdetail_view.php

File: /home/judfadzm/public_html/webinar4demand.com/application/controllers/News.php

File: /home/judfadzm/public_html/webinar4demand.com/application/controllers/News.php

File: /home/judfadzm/public_html/webinar4demand.com/index.phpA PHP Error was encountered

Line: 97

Function: _error_handler

Line: 82

Function: view

Line: 16

Function: index

Line: 317

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Attempt to read property "image_name" on null

Filename: views/newsdetail_view.php

Line Number: 97

Backtrace:

File: /home/judfadzm/public_html/webinar4demand.com/application/views/newsdetail_view.php

Line: 97

Function: _error_handler

File: /home/judfadzm/public_html/webinar4demand.com/application/controllers/News.php

Line: 82

Function: view

File: /home/judfadzm/public_html/webinar4demand.com/application/controllers/News.php

Line: 16

Function: index

File: /home/judfadzm/public_html/webinar4demand.com/index.php

Line: 317

Function: require_once

SLNH Cumulative Revenue by Quarter (Graphic: Business Wire)

John Belizaire, CEO of Soluna, said, “Soluna continues to move at a fast pace and has achieved several important milestones this quarter including, launching our Soluna Cloud AI business and strategic partnership with Hewlett Packard Enterprises (HPE), securing financing for our Project Dorothy expansion and breaking ground and securing $25 million of growth capital. Project Kati has reached several important milestones and Project Rosa is accelerating with the signing of Term Sheets for power and land this quarter. Our financial results continue to build strongly with the company achieving its highest third quarter year-to-date revenue, $29.7 million.”

Soluna is on a mission to make renewable energy a global superpower, using computing as a catalyst. The company designs, develops, and operates digital infrastructure that transforms surplus renewable energy into scalable computing resources. Soluna’s data centers are strategically co-located with wind, solar, and hydroelectric power plants to support high-performance computing applications, including Bitcoin mining, generative AI, and other compute-intensive tasks.

Soluna ensures seamless integration with renewable energy power plants, providing cost-effective and sustainable computing solutions while providing the flexible load required for a greener grid. The Company now operates through three core subsidiary businesses:

- Soluna Digital (“Digital”) – Bitcoin Hosting and Proprietary mining business that builds, owns, and operates its modular, behind-the-meter, data centers delivering managed infrastructure to hyperscale miners. Digital develops data centers co-located with renewable energy projects.

- Soluna Cloud (“Cloud”) – Soluna’s GPU cloud business provides services for generative AI and colocation services for HPC and enterprise AI workloads. Soluna’s Cloud develops behind-the-meter data centers co-located with renewable energy projects.

- Soluna Energy (“Energy”) – Signs power purchase agreements and leases or acquires land in partnership with renewable energy power producers. It has more than 2.6 GW of a long-term pipeline and delivers grid ancillary services in collaboration with Soluna Digital.

This integrated approach positions Soluna to leverage renewable energy as a global superpower, transforming surplus energy into valuable computing resources across AI, digital assets, and grid services.

Belizaire continued, “Another tangible sign of Soluna’s growth trajectory is the significant expansion of our development pipeline, which is now more than 2.6 GW with 1.2 GW currently in active Term Sheet negotiations. This demonstrates a core competence of the company - our ability to find, evaluate, and secure access to renewable power that is suited to development into data centers for High-Performance Computing/AI and Bitcoin computing with industry-leading costs.”

Corporate Highlights

- Enterprise AI Services with HPE - Soluna Cloud partnered with HPE to make 512 H100 SXM GPUs available, boosting support for generative AI workloads.

- $30 million Expansion and Groundbreaking of Project Dorothy 2 – $30 million funding secured from Spring Lane Capital for a 48 MW expansion of Project Dorothy, Soluna’s flagship behind-the-meter data center. The groundbreaking ceremony for Project Dorothy 2 was held on August 28, 2024, in Texas.

- $25 million Growth Capital Line – Soluna reached important milestones toward access to the previously announced $25 million Standby Equity Purchase Agreement (SEPA).

- $13.75 million Funding for Soluna Cloud – Soluna Cloud reached $13.75 million in total funding after an additional $1.25M raise to enhance its AI offerings.

- 187 MW Pipeline Expansion – Soluna signed term sheets for power and land for Project Rosa, a new 187 MW Data Center indicating an important step forward in the Company’s expansion efforts.

- Leading the Conversation in Renewable Computing – CEO John Belizaire hosted a webinar with HPE on Sustainable AI Practices and attended the 2024 Ai4 Conference to speak on AI’s transformative impact and renewable-powered data centers.

Consolidated Finance and Operational Highlights:

- Strong Third Quarter Revenue Growth - Revenue increased by 30% to $7.5 million in the third quarter of 2024 compared to $5.8 million in the third quarter of 2023.

- Best YTD Revenue to Date - 2024 Year to Date (“YTD”) revenue reached a high of $29.7 million, compared to the 2023 YTD of $10.9 million, a $18.8 million increase or 172%.

- Resilient Adjusted EBITDA - 2024 YTD adjusted EBITDA is $3.5 million, compared to the 2023 YTD loss of ($4.5 million), an increase of $8.0 million driven by continued revenue growth despite Bitcoin halving and early phase, pre-revenue, Soluna Cloud expenses.

- Strong 2024 YTD Cash Growth - Unrestricted cash increased 38% from the end of 2023, reaching $8.8 million.

Subsidiary Financial and Operational Highlights:

Soluna Digital:

- Revenue for the third quarter of 2024 was $7.5 million, currently representing 100% of the company's consolidated revenue. This is an increase of $1.7 million over the third quarter of 2023.

- Total Cost of Revenue for the third quarter of 2024 was $6.0 million, compared to $4.4 million in the third quarter of 2023.

Revenue & Cost of Revenue by Project Site |

||||||||||||||||||||||||

Third Quarter 2024 |

||||||||||||||||||||||||

| Digital | Cloud | Total | ||||||||||||||||||||||

| (Dollars in thousands) | Project Dorothy 1B |

Project Dorothy 1A |

Project Sophie |

Other |

Digital Subtotal | Project Ada |

||||||||||||||||||

| Cryptocurrency mining revenue | $ | 2,811 |

|

$ | - |

$ | - |

$ | - |

$ | 2,811 |

$ | - |

|

$ | 2,811 |

|

|||||||

| Data hosting revenue | - |

|

3,515 |

756 |

- |

4,271 |

- |

|

4,271 |

|

||||||||||||||

| High-performance computing service revenue | - |

|

- |

- |

- |

- |

- |

|

- |

|

||||||||||||||

| Demand response services | - |

|

- |

- |

443 |

443 |

- |

|

443 |

|

||||||||||||||

| Total revenue | 2,811 |

|

3,515 |

756 |

443 |

7,525 |

- |

|

7,525 |

|

||||||||||||||

| Cost of cryptocurrency mining, exclusive of depreciation | 1,963 |

|

- |

- |

- |

1,963 |

- |

|

1,963 |

|

||||||||||||||

| Cost of data hosting revenue, exclusive of depreciation | - |

|

2,025 |

521 |

9 |

2,555 |

- |

|

2,555 |

|

||||||||||||||

| Cost of high-performance computing services | - |

|

- |

- |

- |

- |

2,859 |

|

2,859 |

|

||||||||||||||

| Cost of revenue- depreciation | 1,076 |

|

284 |

152 |

- |

1,512 |

- |

|

1,512 |

|

||||||||||||||

| Total cost of revenue | $ | 3,039 |

|

$ | 2,309 |

$ | 673 |

$ | 9 |

$ | 6,030 |

$ | 2,859 |

|

$ | 8,889 |

|

|||||||

| Gross Profit | $ | (228 |

) | $ | 1,206 |

$ | 83 |

$ | 434 |

$ | 1,495 |

$ | (2,859 |

) | $ | (1,364 |

) | |||||||

Revenue & Cost of Revenue by Project Site |

||||||||||||||||||||

Third Quarter 2023 |

||||||||||||||||||||

| Digital | Digital Total |

|||||||||||||||||||

| (Dollars in thousands) | Project Dorothy 1B |

Project Dorothy 1A |

Project Sophie |

Project Marie |

Other | |||||||||||||||

| Cryptocurrency mining revenue | $ | 1,739 |

|

$ | - |

$ | 47 |

$ | - |

|

$ | - |

$ | 1,786 |

||||||

| Data hosting revenue | - |

|

3,016 |

991 |

- |

|

4 |

4,011 |

||||||||||||

| Demand response services | - |

|

- |

- |

- |

|

- |

- |

||||||||||||

| Total revenue | 1,739 |

|

3,016 |

1,038 |

- |

|

4 |

5,797 |

||||||||||||

| Cost of cryptocurrency mining, exclusive of depreciation | 1,023 |

|

- |

17 |

- |

|

- |

1,040 |

||||||||||||

| Cost of data hosting revenue, exclusive of depreciation | - |

|

1,766 |

384 |

- |

|

- |

2,150 |

||||||||||||

| Cost of revenue- depreciation | 739 |

|

284 |

171 |

6 |

|

- |

1,200 |

||||||||||||

| Total cost of revenue | $ | 1,762 |

|

$ | 2,050 |

$ | 572 |

$ | 6 |

|

$ | - |

$ | 4,390 |

||||||

| Gross Profit | $ | (23 |

) |

$ | 966 |

$ | 466 |

$ | (6 |

) |

4 |

$ | 1,407 |

|||||||

Cumulative Year-to-Date Gross Profit by Quarter - Digital

- Year-to-date 2024 Gross Profit is $12.5 million, compared to the 2023 YTD of $1.0 million.

Soluna Cloud

- Year-to-date and third quarter 2024 total cost of revenue was $2.9 million.

- Funding of an additional $1.25 million to bring the total raised for initial Soluna Cloud funding to $13.75 million to fund Cloud operations and growth of AI.

- Helix One concept phase kicked off with a top-tier hyperscale design firm.

Soluna Energy

- Project Kati secured ERCOT approval for its Reactive Power Study, nearing exit of planning.

- Project Rosa PPA and land Term Sheets signed for a 187 MW Texas-based data center.

- Project Grace announced to build 2 MW of AI data center adjacent to Project Dorothy.

- 8 Term Sheets under active negotiations for over 1.2 GW of new data center projects, bringing the total pipeline size to more than 2.6 GW.

The unaudited condensed consolidated financial statements are available online, here. A presentation of this Third Quarter Update can also be found online, here.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Soluna Holdings, Inc. may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials, and in oral statements made by its officers, directors, or employees to third parties. Statements that are not historical facts, including but not limited to statements about Soluna’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, further information regarding which is included in the Company's filings with the Securities and Exchange Commission. All information provided in this press release is as of the date of the press release, and Soluna Holdings, Inc. undertakes no duty to update such information, except as required under applicable law.

In addition to figures prepared in accordance with GAAP, Soluna from time to time presents alternative non-GAAP performance measures, e.g., EBITDA, adjusted EBITDA, adjusted net profit/loss, adjusted earnings per share, free cash flow. These measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Alternative performance measures are not subject to GAAP or any other generally accepted accounting principle. Other companies may define these terms in different ways.

About Soluna Holdings, Inc (SLNH)

Soluna is on a mission to make renewable energy a global superpower using computing as a catalyst. The company designs, develops and operates digital infrastructure that transforms surplus renewable energy into global computing resources. Soluna’s pioneering data centers are strategically co-located with wind, solar, or hydroelectric power plants to support high-performance computing applications including Bitcoin Mining, Generative AI, and other compute intensive applications. Soluna’s proprietary software MaestroOS(™) helps energize a greener grid while delivering cost-effective and sustainable computing solutions, and superior returns. To learn more visit solunacomputing.com. Follow us on X (formerly Twitter) at @SolunaHoldings.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241115504527/en/